Anz share investment loan application form

Make the most of your savings with an account that meets your everyday banking needs. Minimum Opening Balance K50 KinaCard Issuance Access to Internet

Page 3 of 8 ANZ Mortgage Broker Distribution – Online Supporting Document Kit Personal Statement of Financial Position NAME(S) ASSETS Present value ANZ account(s) Total ANZ Home Loan$ Other financial institution account(s) Total ANZ Investment Loan$ Other Cash Assets (Bonds) ANZ …

The information in this document forms part of the ANZ Share Investment Loan Product Disclosure Statement, 23 May 2016. ANZ Share Investment Loan FEES AND CHARGES 23 MAY 2016 * Charged per collateral class for a period of 25 years Monthly Account Keeping Fee charged to your account where the average monthly loan balance falls

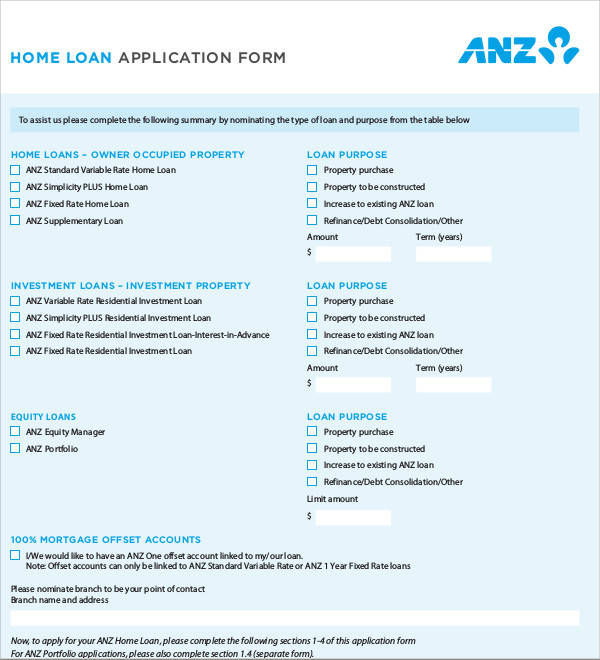

An Eligible ANZ Home Loan is an ANZ Standard Variable Rate Loan, ANZ Fixed Rate Loan or ANZ Simplicity PLUS Loan (secured by a residential investment or owner occupied property) over 0,000.; Following on from the customer’s draw down, the primary account holder will receive an email with instructions on how to access a digital Qantas Points application form.

By submitting this form, you acknowledge and agree to the following: ANZ may collect and disclose your personal information (including to third parties) for the purposes of providing you an ANZ Property Profile Report, and planning and improving ANZ’s products and services. ANZ may also contact you to assist with any home loan needs, or

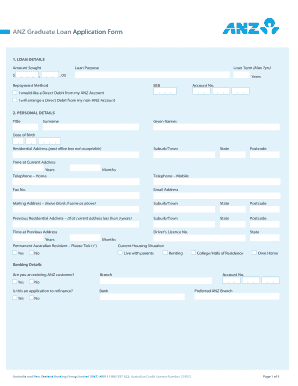

120274 Australia and New Zealand Banking Group Limited (ANZ) ABN 11 00 3 22 Australian Credit Licence Number 234527 Page 2 of 9 Please complete this application and return it together with the information requested below to ANZ. Completion of this form does not ensure the approval of your credit application.

ANZ Personal Loans are available for specific items you want like a new car, renovations, a holiday, or to consolidate your debts. You can apply online here.

3. acknowledge that you have read and understood the ANZ Financial Services Guide, the ANZ Share Investment Loan Product Disclosure Statement and the ANZ Share Investment Loan Fees and Charges and the matters incorporated into it; 4. confirm that the information provided in this Application Form is true and complete and that ANZ may rely on the

Before issuing or increasing the limit of an ANZ Share Investment Loan we assess whether it is unsuitable for you. If your application is approved we can provide you with a copy of this assessment on request. 2. The benefits of an ANZ Share Investment Loan The key benefits of an ANZ Share Investment Loan

Home > Kina Bank > Loans & Advances > Personal > Personal Loan Personal Loan Whether it’s paying for a holiday, wedding or unexpected expense, we offer competitive rates on personal loans.

Is a personal loan right for you? To find out more about what a personal loan is and whether it could be right for you, take a look at our About personal loans page. To get an ANZ Personal Loan you’ll need to meet our lending criteria, including: Be at least 18 years old and receiving a regular income.

Kina Bank’s Home Loan is what you need! If your dream is to own your own home, then look no further than Kina Bank. The Home Loan has very competitive interest rates with outstanding features and benefits. Our Home Loan has a minimum required deposit of 10 per cent, and a maximum repayment term of 30 years.

1 ANZ Mortgage BrokerDistribution Loan Application

homeloanapply.anz.com

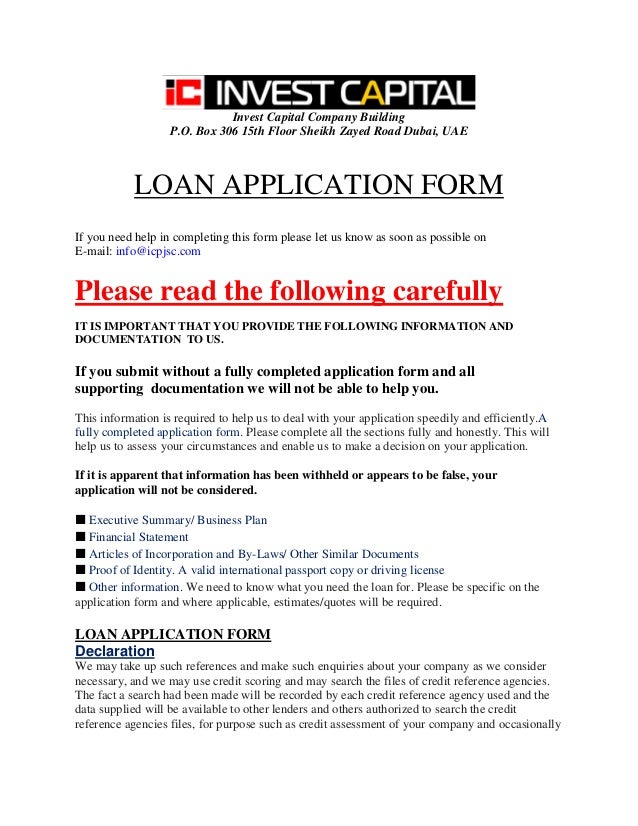

ANZ Business Credit Application form Page 8 of 8 dclie ArAt On Of PurPOse I/We declare that the credit to be provided to me/us by ANZ pursuant to this Credit Application is to be applied wholly or predominantly for business purposes; or investment purposes other than investment in residential property (or for both purposes).

ANZ is the issuer of the ANZ Share Investment Loan and recommends you read the ANZ Share Investment Loan Product Disclosure Statement (PDF 66kB) , and the ANZ Investment Lending Terms and Conditions (PDF 254kB) and the ANZ Financial Services Guide (FSG) (PDF, 112kb) before deciding to acquire or continue to hold the product. Fees and charges apply. All ANZ Investment Lending applications …

ANZ lending criteria, terms, conditions, and fees apply. Interest rates and fees are subject to change. A copy of the Bank’s General Disclosure Statement under the Reserve Bank of New Zealand Act 1989 is available on this website or on request from any ANZ branch, free of charge.. This material is for information purposes only.

Choice and control. With a choice of repayment options, our Business Loan lets you handpick the solutions that suit your business best. Whether you want your finance secured or unsecured, at a fixed or variable rate of interest, for commercial or investment purposes, we can help.

1. ABOUT ANZ AND THE ANZ SHARE INVESTMENT LOAN Australia and New Zealand Banking Group Limited (ANZ) is a licensed Australian bank. ANZ’s Investment Lending team specialises in providing convenient solutions that enable you to use the bank’s funds as well as your own, to invest in the share market. An ANZ Share Investment Loan is a margin

With a BT Margin Loan you can borrow to invest, helping you to diversify your investments and build your wealth so you can prepare for the best in the future. A margin loan is available to Australian residents, companies and trusts. Borrowing to invest increases your potential gains, and your potential losses. Please refer to the PDS for more

ANZ Home Loan for business. If you want to borrow for business purposes, the ANZ Home Loan is available as a floating or fixed interest rate loan, secured against your home or other residential property. If you wish to combine the flexibility of a floating rate for some of your loan with some fixed rate protection against interest rate

The bank offers a range of banking and financial products to more than 5.7 million retail customers, including home loans, credit cards and debit cards, personal loans, savings and banking accounts and personal insurance. And now, with its new mobile banking application, ANZ App, it’s easier to do banking on the go. See ANZ margin loans

How do I apply for the ANZ Share Investing Cash Investment Account? You can apply for this account by visiting ANZ website and filling out an online application form. You will first be asked the

Find relevant forms for our products & services, from opening a bank account to applying for a trade finance loan with ANZ Singapore. Check out the full list.

More about Westpac Online Investment Loan. BT Securities Limited ABN 84 000 720 114 and Westpac Banking Corporation ABN 33 007 457 141 are together the issuers of the Westpac Online Investment Loan – Product Disclosure Statement (“WOIL PDS”). This information has been prepared without taking into account your personal objectives, financial

Welcome to ANZ Investments. Wherever you are on your journey, making the right decisions now could help you achieve your financial goals. Learn more

< ANZ Home Loans Start your ANZ home loan application Once you've submitted this form, you'll get an initial indication of whether ANZ may be able to lend you what you wish to borrow. Please note, you will not be able to use this indication to make an offer on a house or bid at auction, you will need a conditionally pre-approved home loan to do that.

I acknowledge and agree that I will be deemed to receive in full the Loan upon ANZ paying such Loan proceed to the account as instructed in this Application Form. I agree and undertake to ANZ that; (1) ANZ will only pay the approved loan funds into the account as I have instructed in Section 5 of in this Application Form after my loan is

It speeds up the process for getting full loan approval. With full loan approval you'll be in a better negotiating position – having your finance already confirmed makes your offer more attractive. When you get a pre-approved home loan from ANZ, you can also get free ANZ Property Profile Reports (worth .95 each). An ANZ Property Profile

By making additional investments, you agree to be bound by the funds’ terms and conditions current at the time of making the investment, as set out in the application form, guide, product disclosure statement, offer register and governing document applicable at that time. Our email address for forms is: registry@anzinvestments.co.nz

First Home Withdrawal Application Form. Complete the application form and give it to your New Zealand solicitor (or licensed conveyancer) with the attached letter. They’ll also need to send us all the other documents listed on the application form.

ANZ Investment Lending Reply Paid 4338 Melbourne VIC 8060 Or fax to: 1800 186 286. If you would like further information, please complete the form below *. Enter the details of your query ensuring all mandatory fields that are marked with an asterisk are completed. Press the ‘submit’ button to send your enquiry to an ANZ Customer Service

© Australia and New Zealand Banking Group Limited (ANZ) 2016 ABN 11 005 357 522. ANZ’s colour blue is a trade mark of ANZ.

Commission share on referrals to third party advice providers. Advertisement “Featured” Products and “Advertisement” are a form of advertising. InfoChoice may receive a commission, referral, fee, payment or advertising fees from a provider when you click on a link to a product. We may sort or promote the order of these products based on

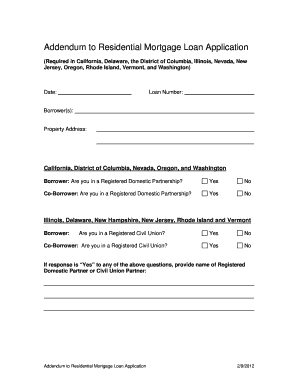

Home Loan Application Form 1.3 Home Loan appLication form do not use this page for anZ portfolio. please use section 1.4 instead. compLete for aLL Loans wHere property is purcHased compLete for aLL Loans wHere a refinance is to occur compLete for aLL Home or residentiaL investment Loans (ie. Leave bLank for anZ equity manager) Purchase price $

Savings Account Kina Bank

Borrow between FJD,000 – FJD,000 for unsecured lending and between FJD,000 – FJD,000 for secured lending (including Car loans). Open an account now. Apply for an ANZ Personal Loan by visiting your local ANZ branch or call 0800 3316 644 to speak to an ANZ …

All ANZ Share Investment Loan applications are subject to ANZ’s credit approval criteria. Fees and charges apply and are available here or by calling the Client Services Team on 1800 639 330 between 8.00am and 6.00pm (Sydney time) during ASX trading days.

2 investment loan application form. how to use this form – please use capital letters. step 1 – before you start. ensure that you have read. the commsec adviser services investment loan terms and conditions

Our track record, expertise and disciplined approach make ANZ Investment Funds a great investment option. Complete the application form online, or call us.

1 ANZ Mortgage BrokerDistribution – Loan Application Cover Sheet 09.2006. 2 2.1 ANZ Mortgage Broker Distribution – Loan Application Personal Details (Primary Applicant) Applicant Director/ Partner Guarantor First Home Buyer Personal Details Employment Details (minimum 2 year history) Address Details (minimum 2 year history) Accountant Details (mandatory for self-employed customers) Solicitor

It does not constitute a quote. To apply for an ANZ Personal Loan you must complete an application. If a Variable Rate Loan is selected, the interest rate will be subject to change throughout the term of the Loan. ANZ will not store the information provided in this calculator.

• ANZ Share Investment Loan Application Form Page 4 • Form 1 – Customer Identification Process Page 25 • Form 2 – Refinance Request Page 27 • Form 3 – Share Transfer Authorisation Page 29 • Form 4 – Managed Funds Application/Lodgement Authority Page 31 • Glossary Page 33 What you may need for your Application Information you may need to complete this application Who you are

The ANZ Investment Funds product disclosure statement includes the following forms to open a new ANZ Investments account: ANZ Investments Application Form (Individuals and Joint Investors) – Form 1; ANZ Investments Application Form (Companies, Trusts, Partnerships and Estates) – Form 2; Additional forms for Companies, Trusts, PartnershipsA personal loan can also be used for the purposes of consolidating existing debts. You pay the loan back in regular scheduled repayments that are arranged during the application process. We will charge you interest on the loan amount that will be paid back over the term of the loan and may charge an application …

What happens after you complete the application form? We’ll contact you if we need further information to process your application. If you are new to ANZ, you may need to visit an ANZ branch with proof of address and identification before your application can be completed.

To apply for an ANZ Home Loan, you can start your application online, call us, or we can come to you. Find out here what you will need before you apply.

ANZ Home Loan Application Introduction

ANZ Share Investing Buy Shares & Trade Online ANZ

Investment loans ANZ

ANZ KiwiSaver Documents and Forms ANZ

ANZ Share Investment Loan Margin Loans. Flexible lending

Investment Loan Application Form CommSec Adviser Services

gta 5 all 10 tracts location guide

PRODUCT DISCLOSURE STATEMENT ˜“PDS”˚ 200| 1302 ANZ

https://en.wikipedia.org/wiki/ANZ_Banking

Personal Loan Borrowing Power Tool ANZ

ANZ Share Investing Cash Investment Account Review

Property Profile Report ANZ

ANZ Investment Lending Accounts credit cards loans

Margin loans ANZ

The bank offers a range of banking and financial products to more than 5.7 million retail customers, including home loans, credit cards and debit cards, personal loans, savings and banking accounts and personal insurance. And now, with its new mobile banking application, ANZ App, it’s easier to do banking on the go. See ANZ margin loans

Home Loan Kina Bank

Personal Loan Borrowing Power Tool ANZ

1. ABOUT ANZ AND THE ANZ SHARE INVESTMENT LOAN Australia and New Zealand Banking Group Limited (ANZ) is a licensed Australian bank. ANZ’s Investment Lending team specialises in providing convenient solutions that enable you to use the bank’s funds as well as your own, to invest in the share market. An ANZ Share Investment Loan is a margin

Documents and Forms Welcome to ANZ Investments

Investment Loan Application Form CommSec Adviser Services

Why ANZ Investment Funds? ANZ

Borrow between FJD,000 – FJD,000 for unsecured lending and between FJD,000 – FJD,000 for secured lending (including Car loans). Open an account now. Apply for an ANZ Personal Loan by visiting your local ANZ branch or call 0800 3316 644 to speak to an ANZ …

Phone 13 13 31 Application Form Individual Joint

The ANZ Investment Funds product disclosure statement includes the following forms to open a new ANZ Investments account: ANZ Investments Application Form (Individuals and Joint Investors) – Form 1; ANZ Investments Application Form (Companies, Trusts, Partnerships and Estates) – Form 2; Additional forms for Companies, Trusts, Partnerships

1 ANZ Mortgage BrokerDistribution Loan Application

ANZ KiwiSaver Documents and Forms ANZ

Loans to invest in approved shares Westpac

Borrow between FJD,000 – FJD,000 for unsecured lending and between FJD,000 – FJD,000 for secured lending (including Car loans). Open an account now. Apply for an ANZ Personal Loan by visiting your local ANZ branch or call 0800 3316 644 to speak to an ANZ …

ANZ Qantas Points With Cashback

The information in this document forms part of the ANZ Share Investment Loan Product Disclosure Statement, 23 May 2016. ANZ Share Investment Loan FEES AND CHARGES 23 MAY 2016 * Charged per collateral class for a period of 25 years Monthly Account Keeping Fee charged to your account where the average monthly loan balance falls

Why ANZ Investment Funds? ANZ

Kiwisaver Apply Online ANZ

Borrow between FJD,000 – FJD,000 for unsecured lending and between FJD,000 – FJD,000 for secured lending (including Car loans). Open an account now. Apply for an ANZ Personal Loan by visiting your local ANZ branch or call 0800 3316 644 to speak to an ANZ …

Documents and Forms Welcome to ANZ Investments

The ANZ Investment Funds product disclosure statement includes the following forms to open a new ANZ Investments account: ANZ Investments Application Form (Individuals and Joint Investors) – Form 1; ANZ Investments Application Form (Companies, Trusts, Partnerships and Estates) – Form 2; Additional forms for Companies, Trusts, Partnerships

ANZ Share Investing Buy Shares & Trade Online ANZ

Investment loans ANZ

ANZ Business Credit Application form Page 8 of 8 dclie ArAt On Of PurPOse I/We declare that the credit to be provided to me/us by ANZ pursuant to this Credit Application is to be applied wholly or predominantly for business purposes; or investment purposes other than investment in residential property (or for both purposes).

ANZ INVESTMENT LENDING FACILITY LIMIT INCREASE

< ANZ Home Loans Start your ANZ home loan application Once you've submitted this form, you'll get an initial indication of whether ANZ may be able to lend you what you wish to borrow. Please note, you will not be able to use this indication to make an offer on a house or bid at auction, you will need a conditionally pre-approved home loan to do that.

How to apply for a Home Loan ANZ

ANZ Investment Lending Reply Paid 4338 Melbourne VIC 8060 Or fax to: 1800 186 286. If you would like further information, please complete the form below *. Enter the details of your query ensuring all mandatory fields that are marked with an asterisk are completed. Press the ‘submit’ button to send your enquiry to an ANZ Customer Service

ANZ Share Investment Loan

To apply for an ANZ Home Loan, you can start your application online, call us, or we can come to you. Find out here what you will need before you apply.

Personal Loan Borrowing Power Tool ANZ

ANZ Business Credit Application form

ANZ INVESTMENT LENDING FACILITY LIMIT INCREASE

With a BT Margin Loan you can borrow to invest, helping you to diversify your investments and build your wealth so you can prepare for the best in the future. A margin loan is available to Australian residents, companies and trusts. Borrowing to invest increases your potential gains, and your potential losses. Please refer to the PDS for more

ANZ Share Investing Buy Shares & Trade Online ANZ

Before issuing or increasing the limit of an ANZ Share Investment Loan we assess whether it is unsuitable for you. If your application is approved we can provide you with a copy of this assessment on request. 2. The benefits of an ANZ Share Investment Loan The key benefits of an ANZ Share Investment Loan

ANZ Share Investing InfoChoice

Margin loans ANZ

Investment Loan Application Form CommSec Adviser Services